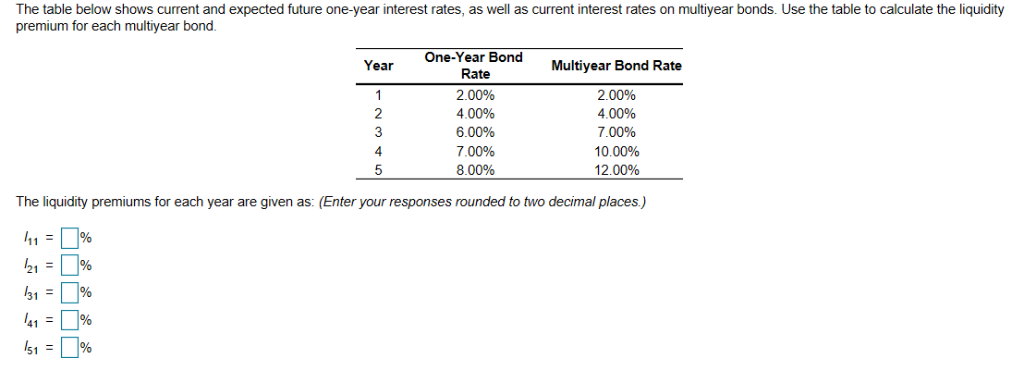

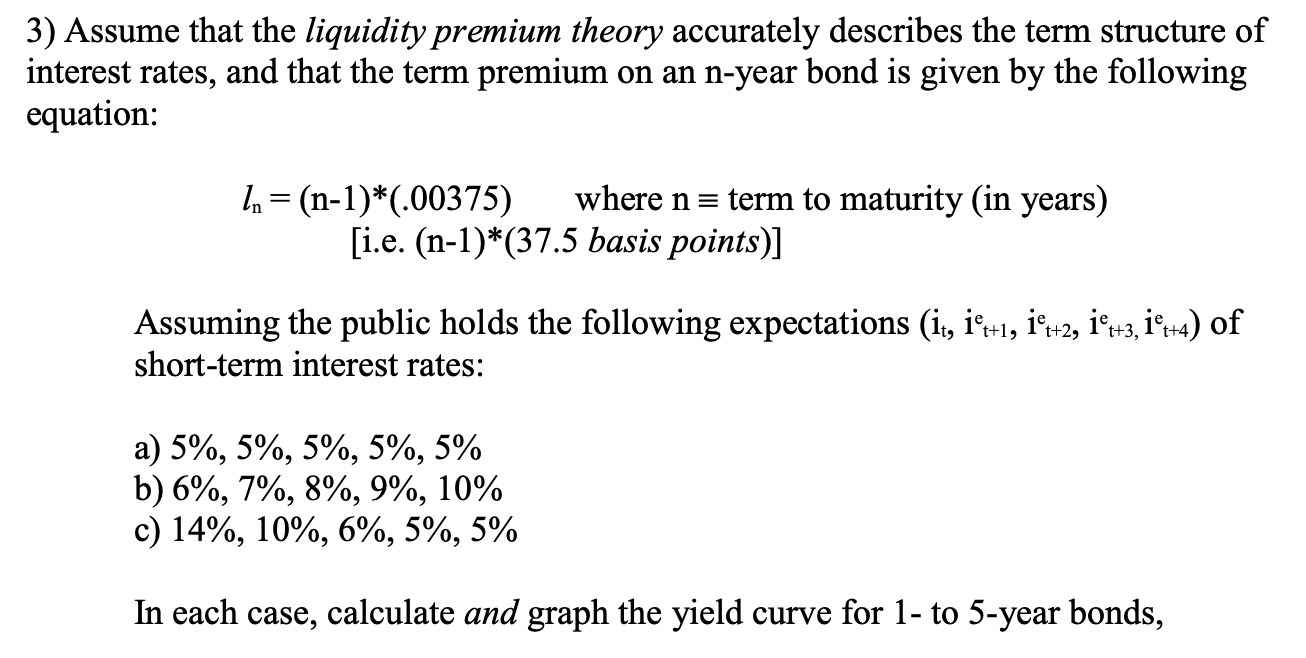

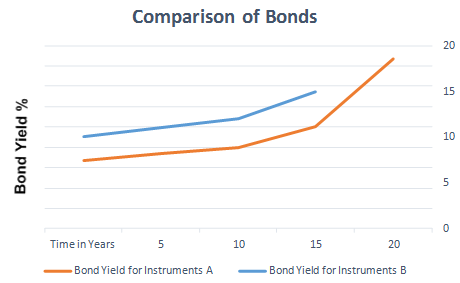

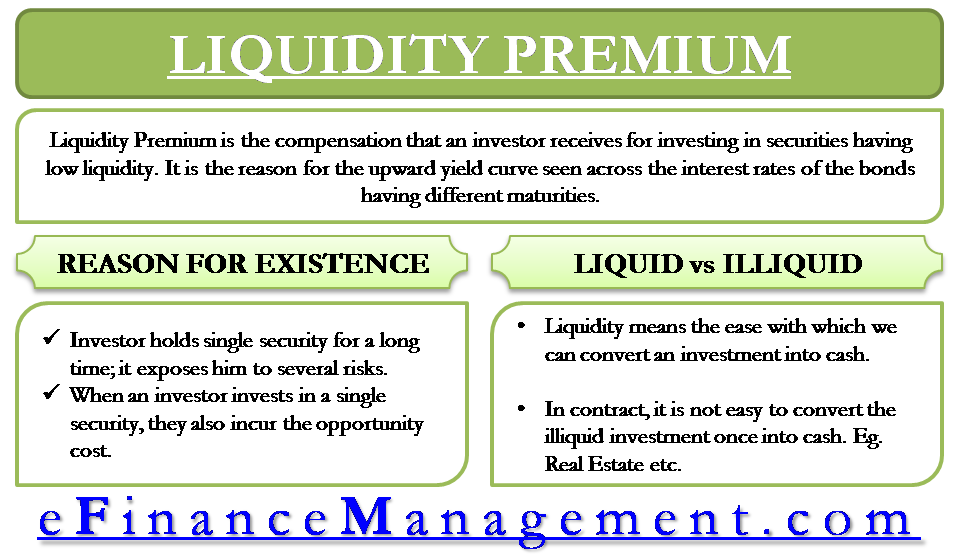

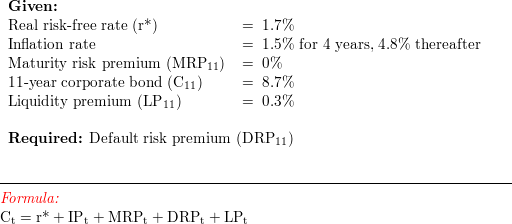

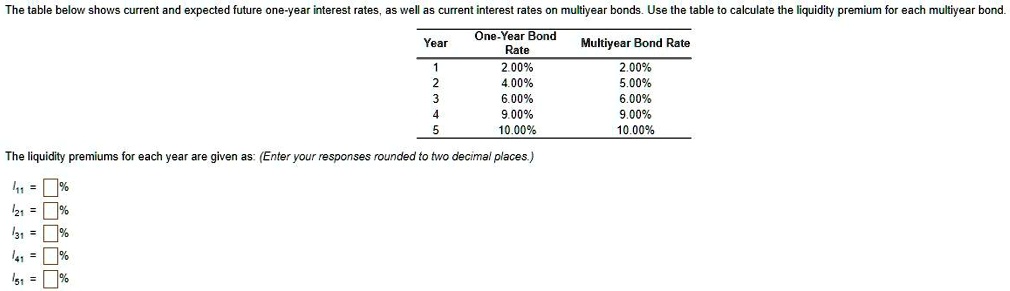

SOLVED: The table below shows current and expected future one-year interest rates, as well as current interest rates on multiyear bonds. Use the table to calculate the liquidity premium for each multiyear

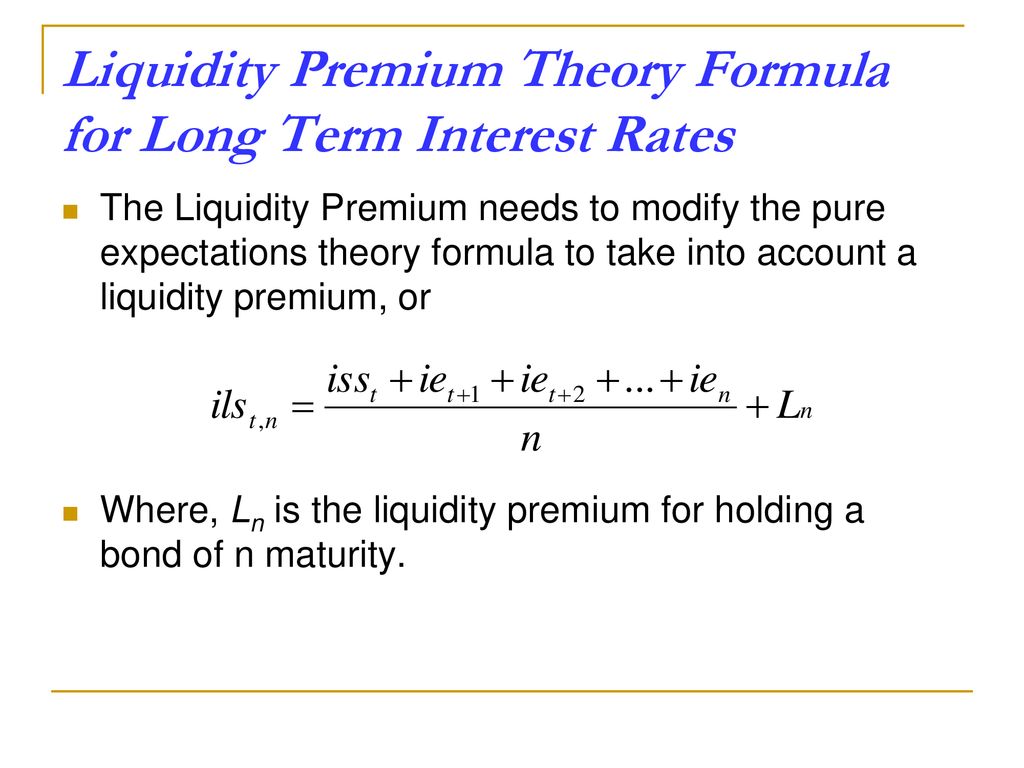

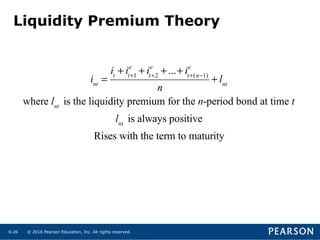

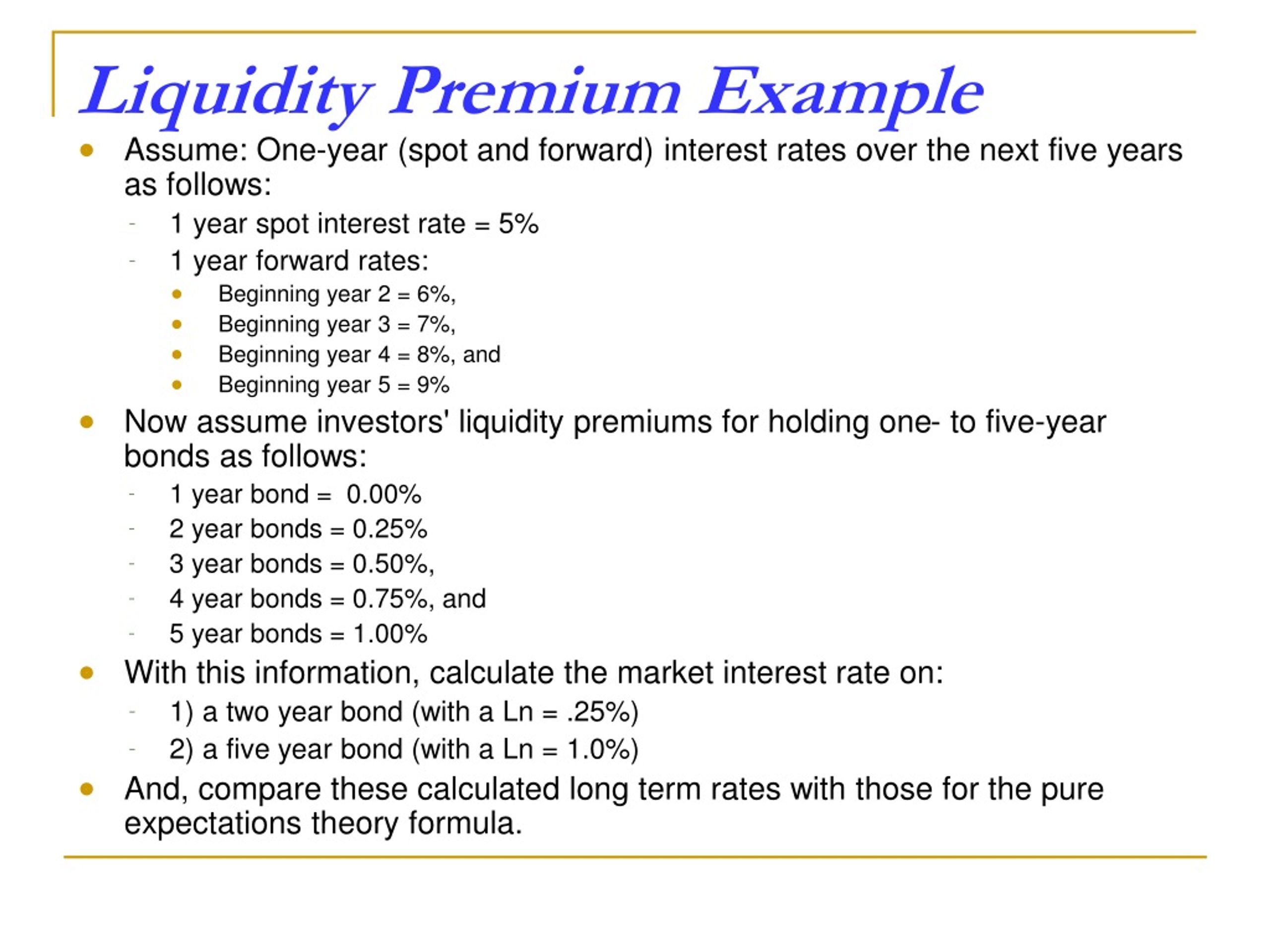

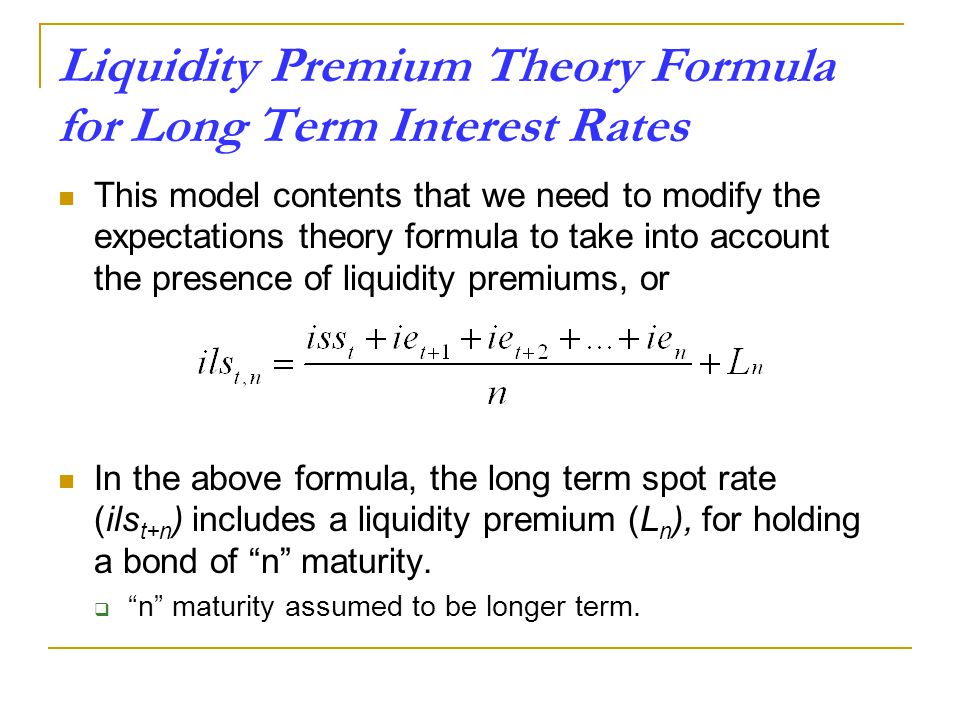

FNCE 3020 Financial Markets and Institutions Fall Semester 2006 Lecture 5: Part 2 Forecasting Interest Rates with the Yield Curve. - ppt download

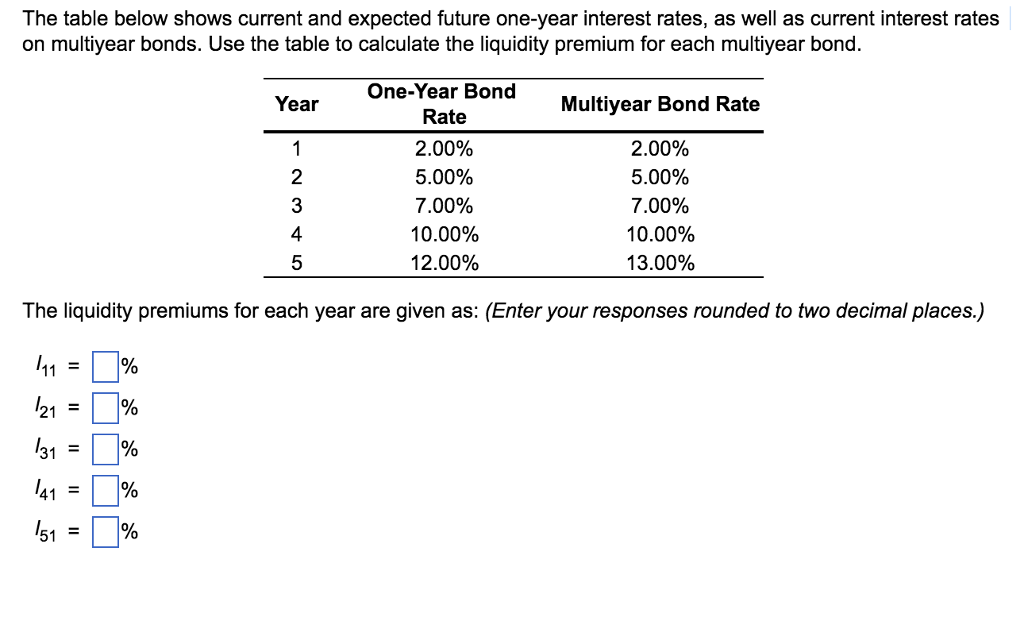

SOLVED: 1.(15) Over the next three years, the expected path of 1-year interest rates is 4, 1 and 1 percent. The liquidity premiums for the one year rate are 0%, 1.0% and

One-year interest rate over the next five years are 4%, 4.5%, 6%, 8%, and 9% respectively. Liquidity premiums for one- to five-year bonds are estimated to be 0%, 0.5%, 1.5%, 2.5%, and